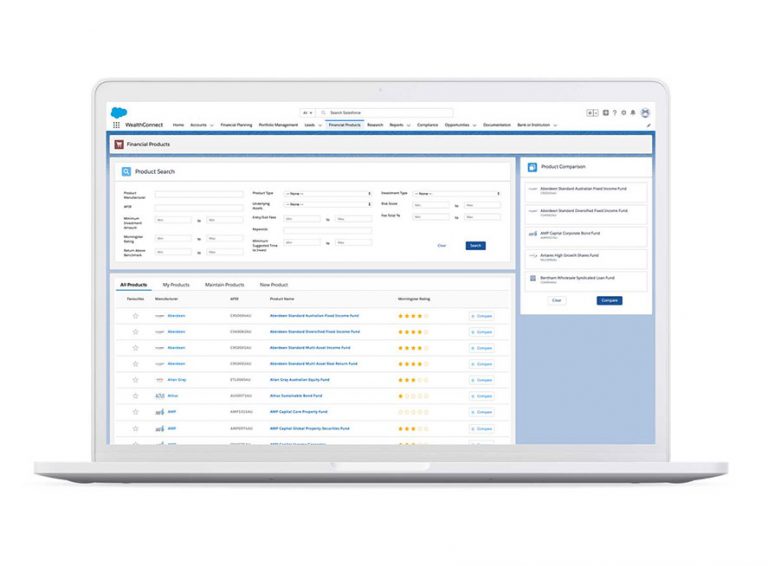

CreativeMass offers a Salesforce driven Product called ‘WealthConnect’ which seamlessly integrates the customer first principles of the CRM platform with that of modern technology delivered fast and effectively for asset management and investment advice.

As part of my role as a Business Analyst / Scrum Master at CreativeMass, I was responsible for documentation, communication of Requirements, and managing the delivery cycles for the Portfolio Management Delivery team (Product Manager, Developer, Data Engineers).

Discovery

The Portfolio Management capabilities and functionality was not developed, and as a result our newly formed Pod was responsible to deliver features from the ground up.

By speaking to internal Stakeholders and Clients, I worked closely with the Product Manager to develop a Requirements Document which was used to support the initial phase of the Portfolio Management build.

Ideation

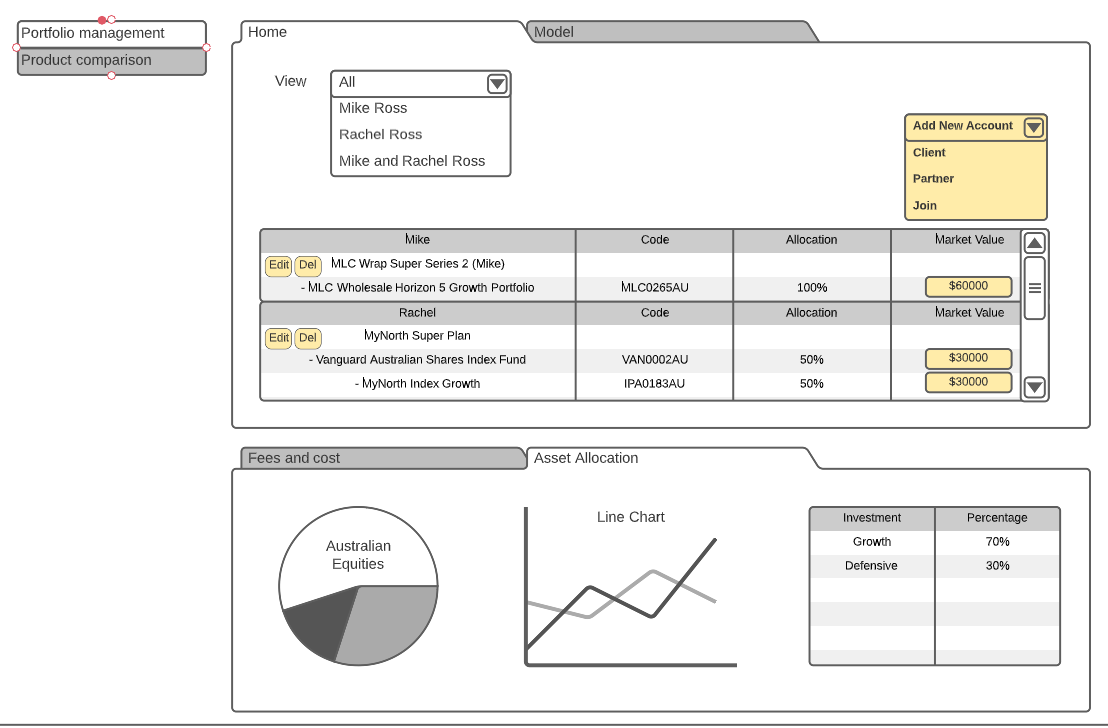

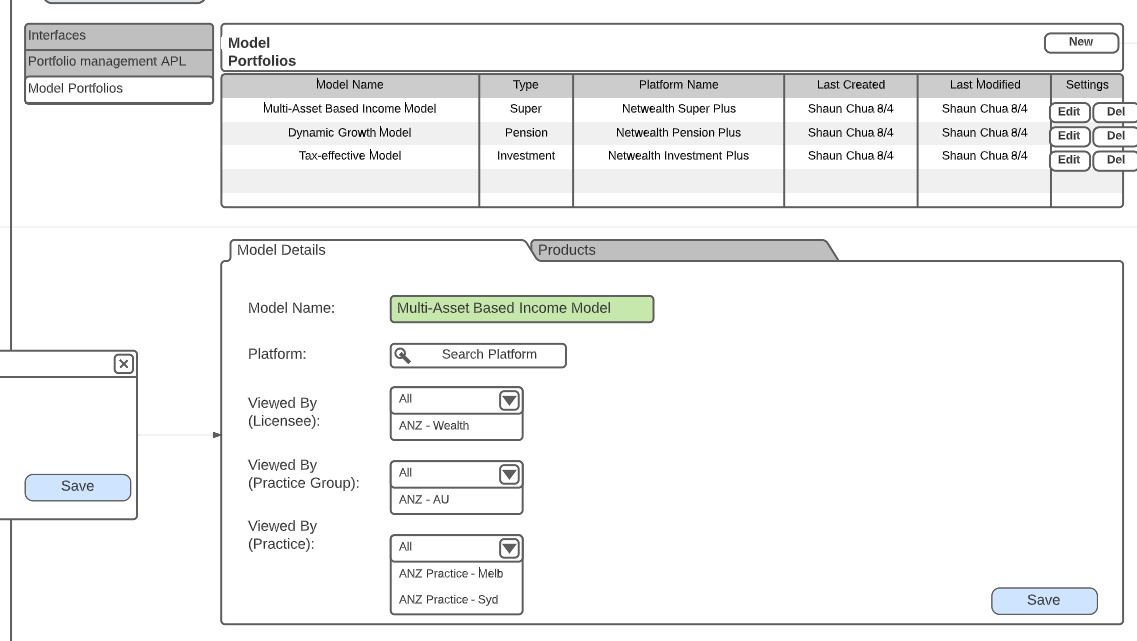

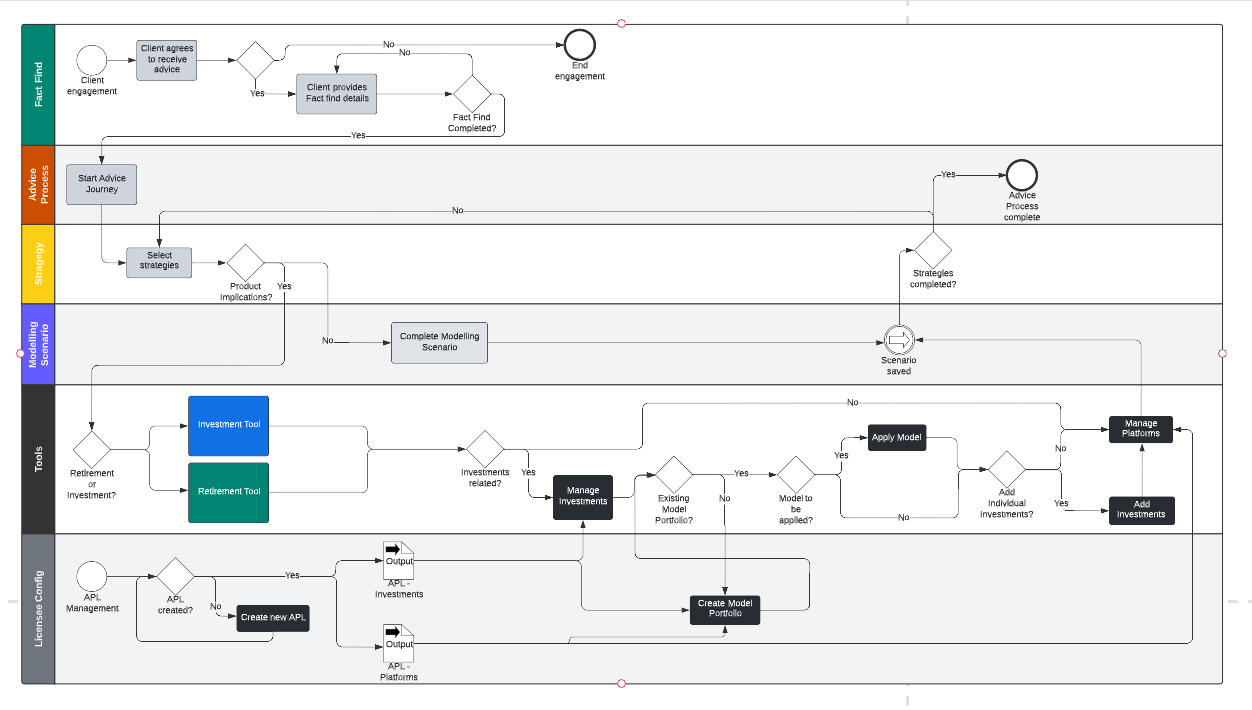

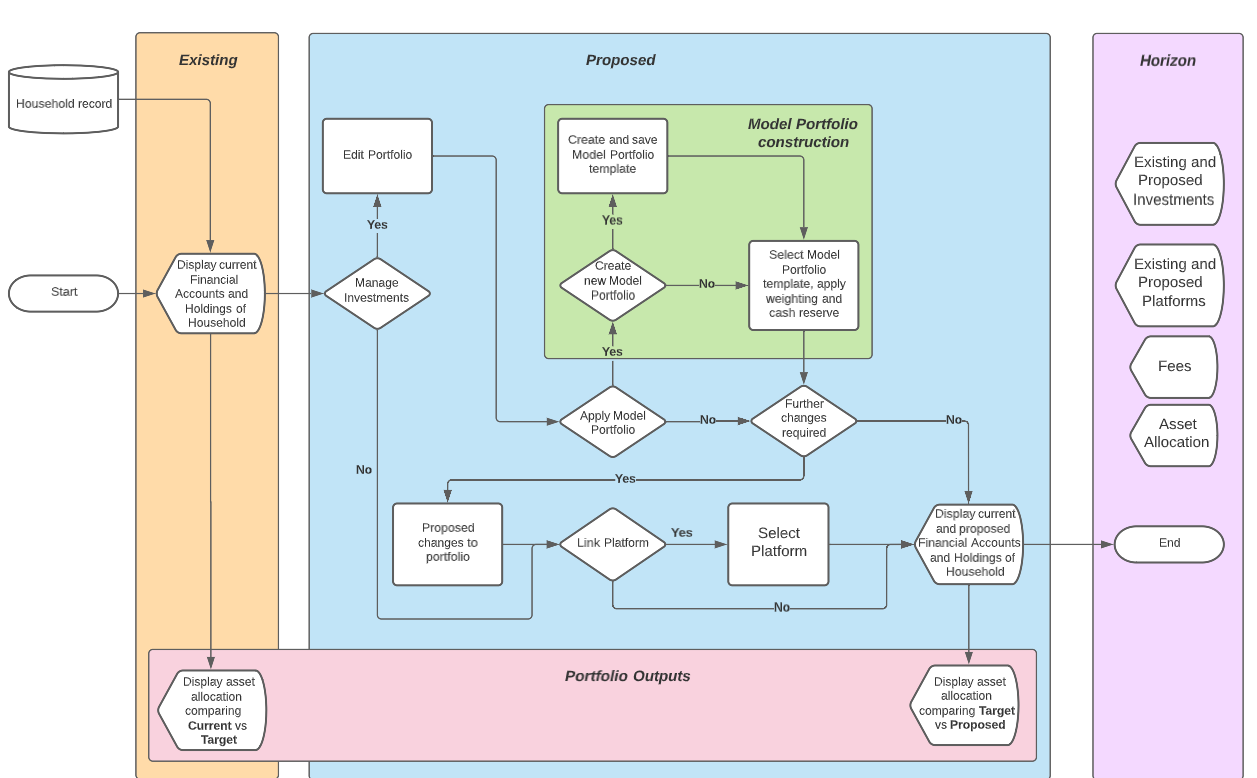

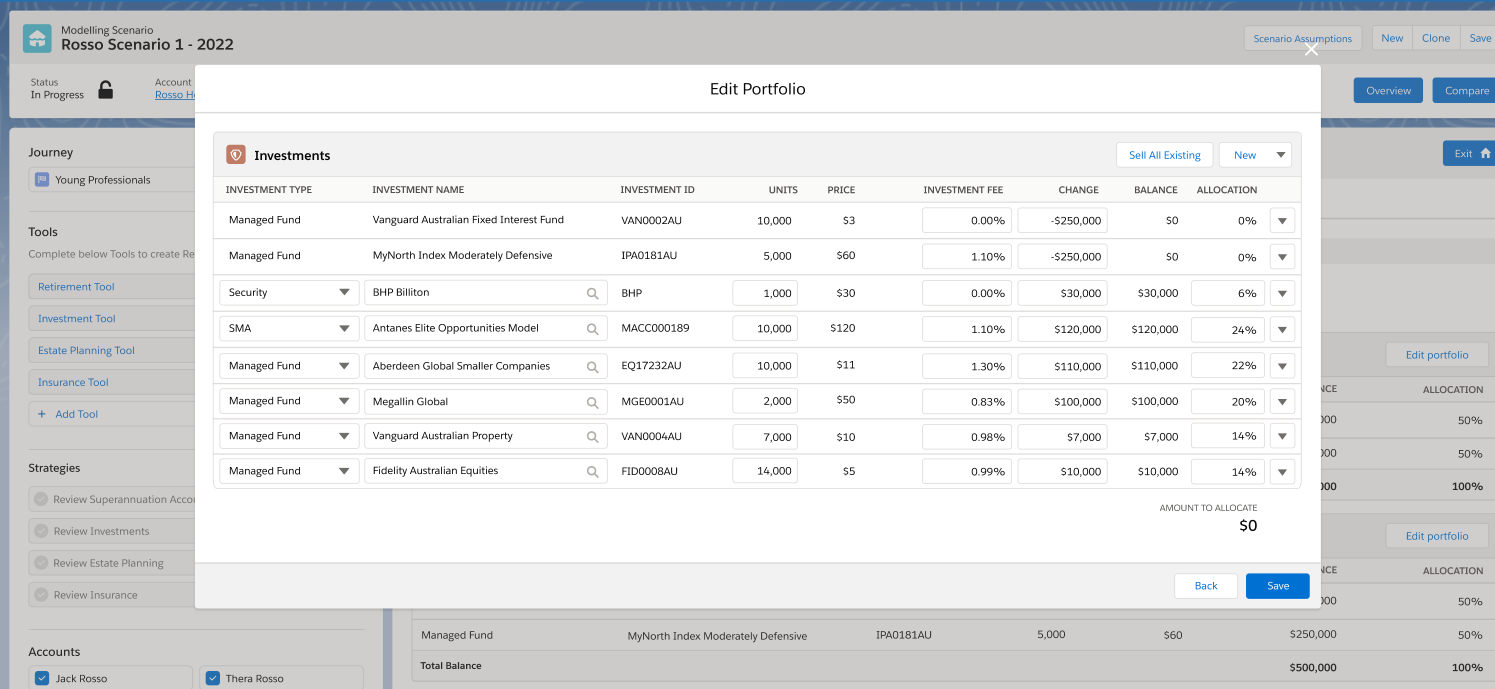

Process diagrams and wireframes were created to support the communication to Clients and internal Stakeholders.

Designs were communicated and discussed with relevant internal Stakeholders (Product Managers, Client Delivery and Sales leads) to determine the best approach, iterating until the best solution was agreed upon.

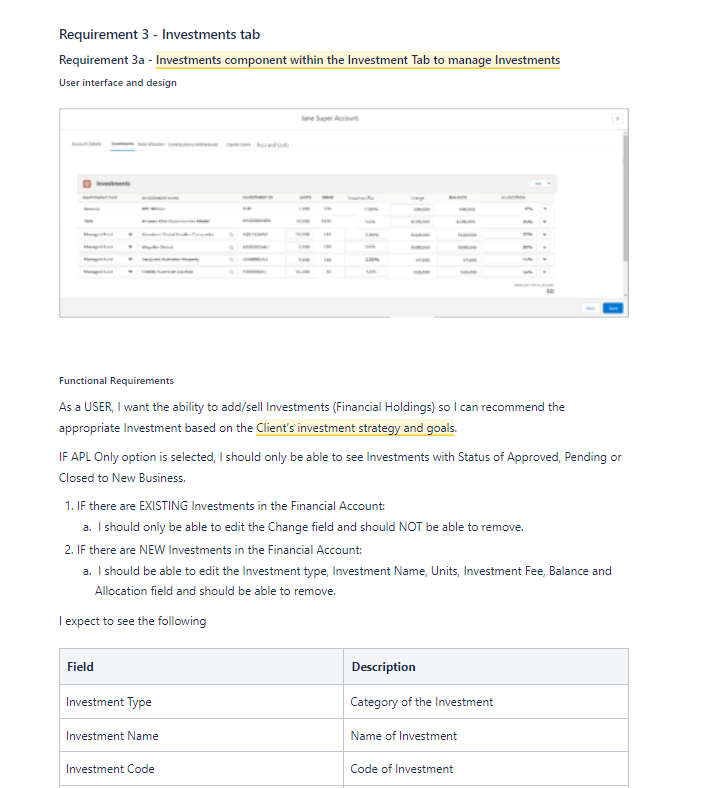

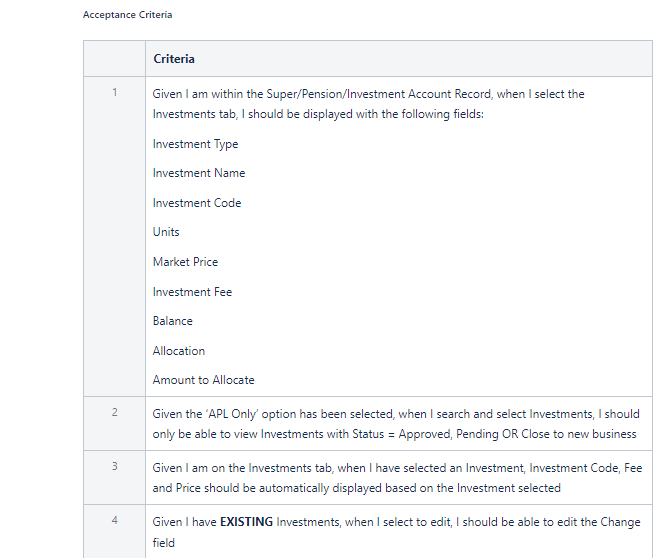

Once the wireframes and Process flows were agreed, high fidelity designs were created, working closely with the Design team. Detailed requirements were documented to support the technical and functional specifications.

Delivery

Requirements were translated to User Stories which included functional requirements and Designs. This was communicated to the Developers to ensure that they understood what the build looked like, and how the functionality should operate.

I continued to maintain daily scrum responsibilities to ensure the delivery was on time, questions were answered and addressed.

Business Results

- Built a new Schema object to support data integration for a new Data Provider.

- Ability for Users to create Model Portfolio templates.

- Additional functionality and feature to the Modelling Scenario component which allows Users to recommend Securities and model their returns.