Caleb & Brown is the world’s leading cryptocurrency brokerage, providing a professional service by which clients can safely buy, sell, and swap cryptocurrencies through their very own personal broker.

During my tenure at Caleb & Brown, I was responsible for Trade functionalities within the Web Portal. The company had endeavored to provide more features and functionality in a newly developed Web Portal to enable Clients to have access to Trade.

Discovery

In order to validate and prioritize which were most important, I looked through previous customer surveys and interviews that were done to identify key trends. There were a number of key items that were identified such as being able to place Market Order trades, an ability to place Limit and Target orders, and ability to create price notifications.

Some of the key concerns and feedback that were raised from Clients were:

1. Execution of Trades via an Email were not secure

2. Minimum cost of initial investment was a barrier to entry

3. Speed and self service was not available as Trades had to be emailed to a Broker

Out of the number of key items identified, Market Order trades was identified as the biggest opportunity and value to customers based on the feedback received. The reasoning behind this was:

1. The existing process to place Market Orders was a large pain point for customers

2. Market Orders was the foundation leading to other Trade functionalities

3. This feature would help enhance the existing process by saving man hours, resulting in saving operating costs

Ideation

Once the problem was identified and prioritized, I worked with Design, Development and Business Units (Legal and Compliance, Brokers, Customer Support) through the Ideation process to determine solutions. I facilitated several workshops and brainstorming sessions to determine what the solution could look like and what types of functionality we wanted to have.

Some of the tools and techniques used were:

1. Clustering

2. Customer Journey Map

3. Wireframing

4. Priority Matrix

After the discussions, we came to a conclusion on the wireframe prototypes and I worked closely with the team to define Requirements and Acceptance Criteria.

There were some assumptions that I made and wanted to validate through this solution:

1. A greater experience for users to Trade may contribute to greater Trading activity and having a positive affect on Revenue.

2. Trade monitoring would help users feel a sense of comfort that the Trade was going to be completed.

Delivery

To clearly define what the requirements were, I introduced a new process with the team to help document each requirement and have the relevant information clearly outlined so there was no confusion.

I guided the development team through this process, ensuring designs were updated and presented in a way that Developers could understand.

I also worked closely with Client facing teams (Brokers, Client Support), Legal, Compliance and Marketing through regular discussions and updates as well as a company wide Demo to ensure the company was across the Product and had relevant input before it went to Clients.

There was some feedback that were not considered in the initial Ideation due to miscommunication, however the development team worked quickly to address this issue and we managed to deliver a greatly adopted Feature within the Portal.

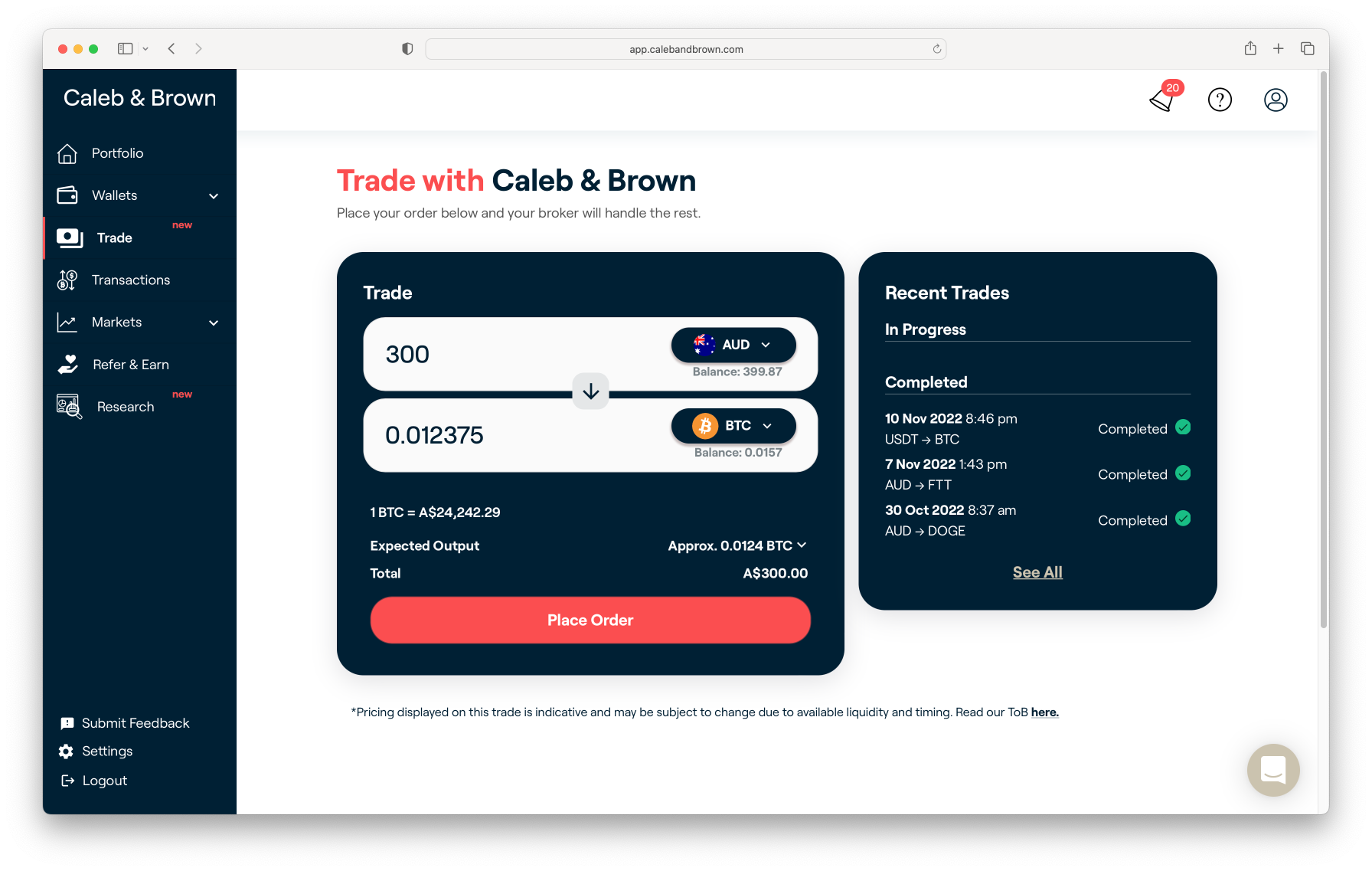

This feature allowed Clients to:

– Select Buy and Sell Currencies

– Identify an expected amount received and any Fees involved

– Monitor Completed and In Progress Trades

In addition, as a result of a technical implemented for execution of Trades, this enabled a business decision to reduce initial Trade minimums to $500, from $2000

Business Results

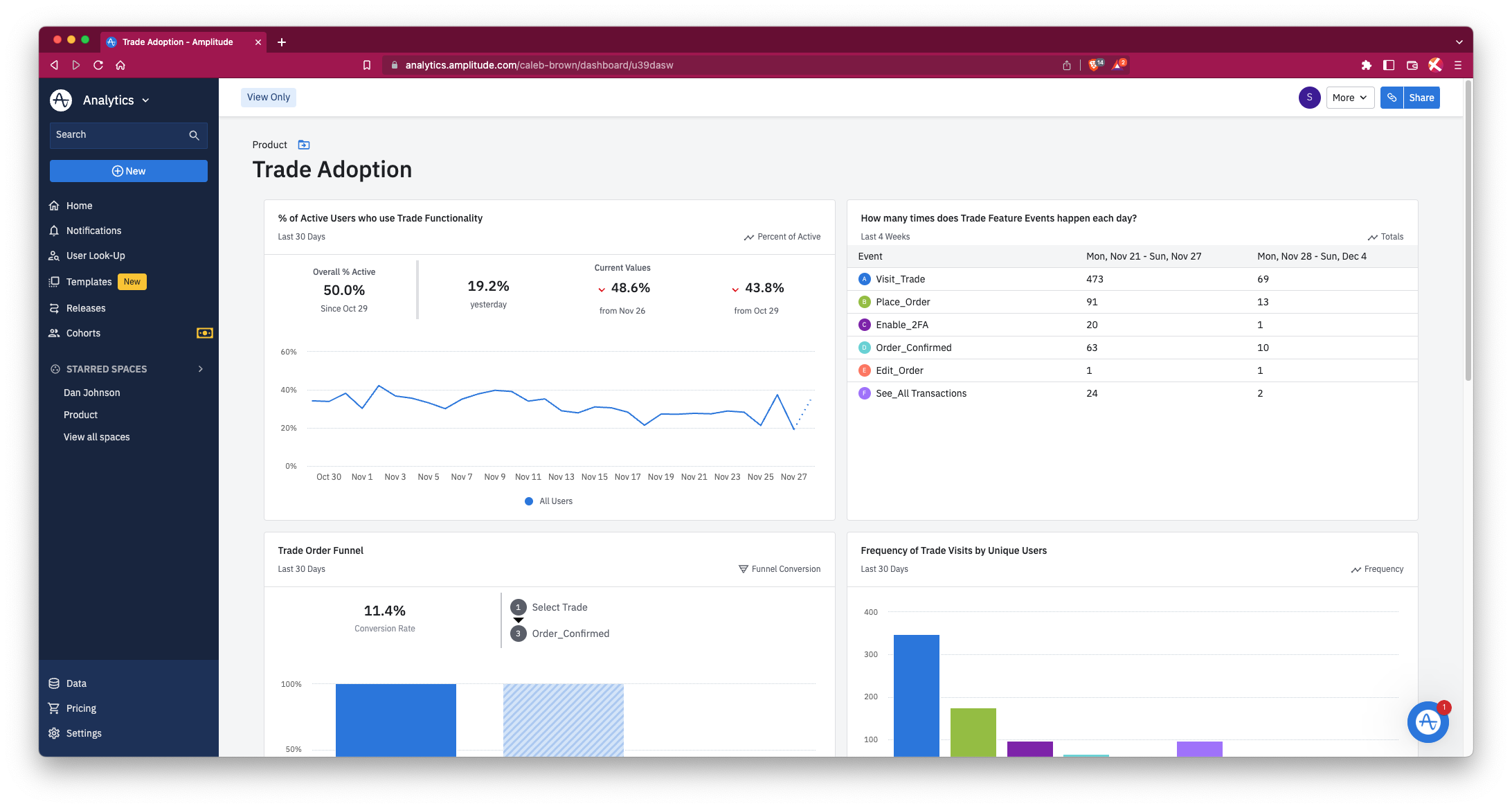

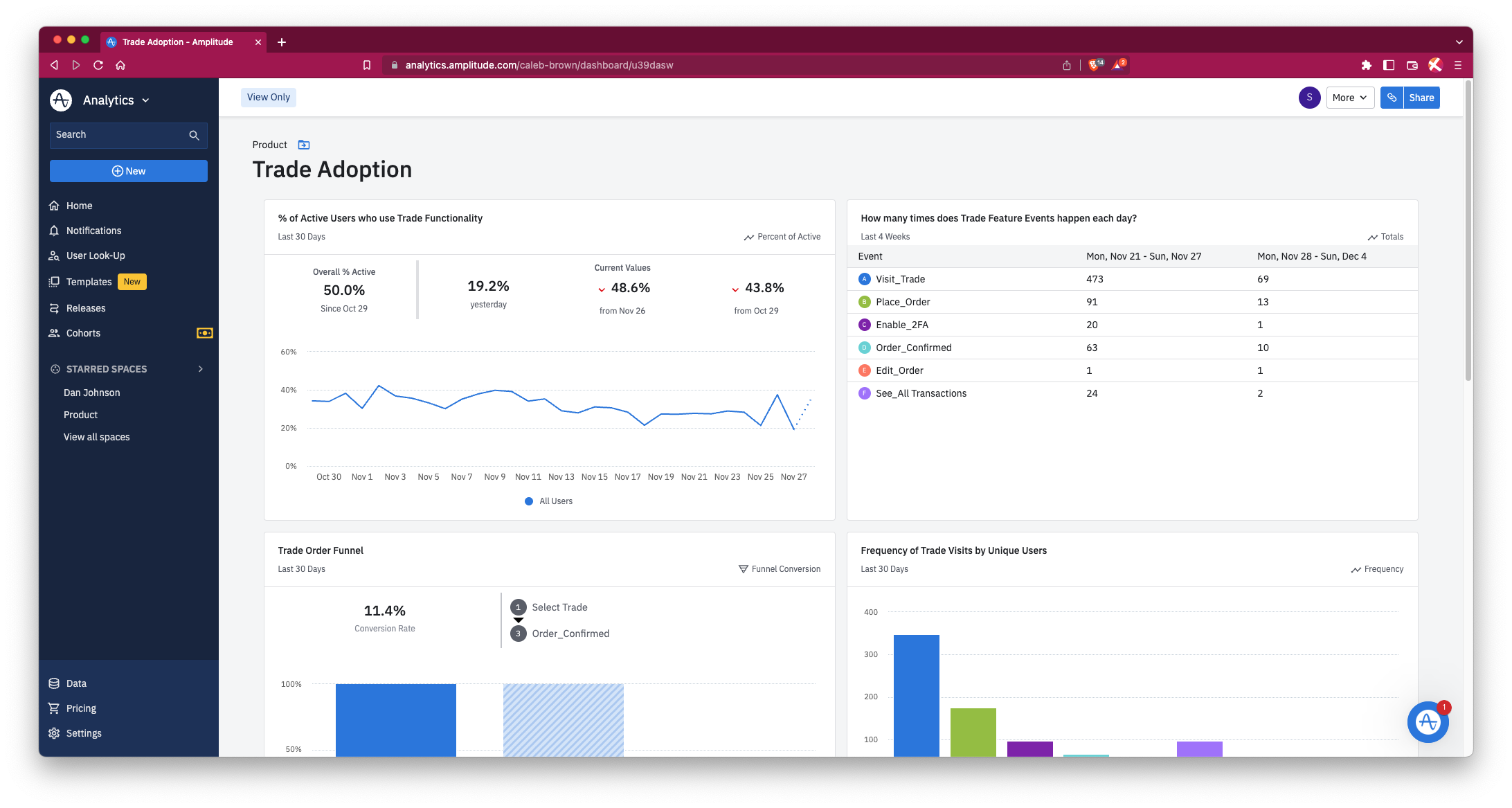

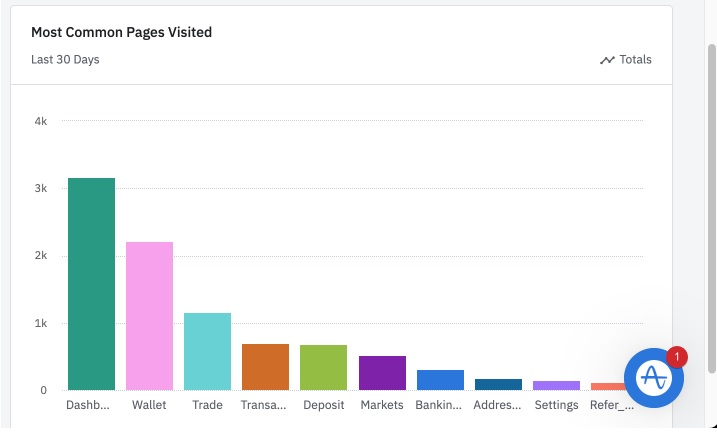

This feature was able to achieve

1. Over 40% of active user adoption (closer to 50% at the time of screenshot)

2. > $3 million AUD in volume Traded, accounting for ~10% of monthly volume